To enlighten investors on the impact of the breakthroughs and opportunities they should embark on, ARK Invest began publishing Big Ideas in 2017. The annual research reports seek to highlight the latest development in innovation and offer some of ARK's most provocative research conclusions for the year.

Digital Wallets by 2025 could represent a $4.6 Trillion market, and according to ARK's research, the value of digital wallets, which is between $250 to $1,900 per user, could rocket up to $20,000 per user. As of today, digital wallets are starting to act as an entire traditional financial service institution, which includes brokerage and lending. Digital wallets could go on to serve as a leader for commercial activity beyond financial products.

And ARK believes that Venmo, Cash App, and venture-funded startups are likely to overturn traditional banking from the users' pockets.

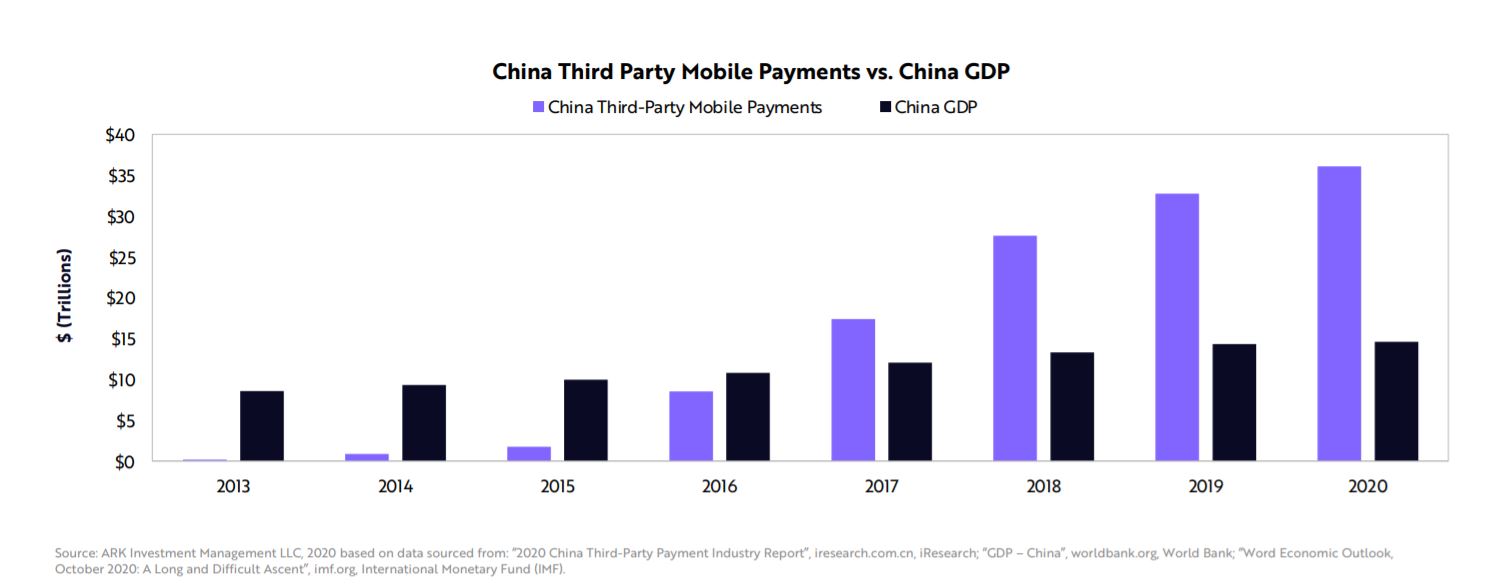

Nurtured In China, Mobile Payments Are 2.5x Its GDP

The volume of mobile payments in China has exploded more than 15-fold in just five years, from roughly $2 trillion in 2015 to an estimated $36 trillion, nearly three times the size of China's GDP in 2020.

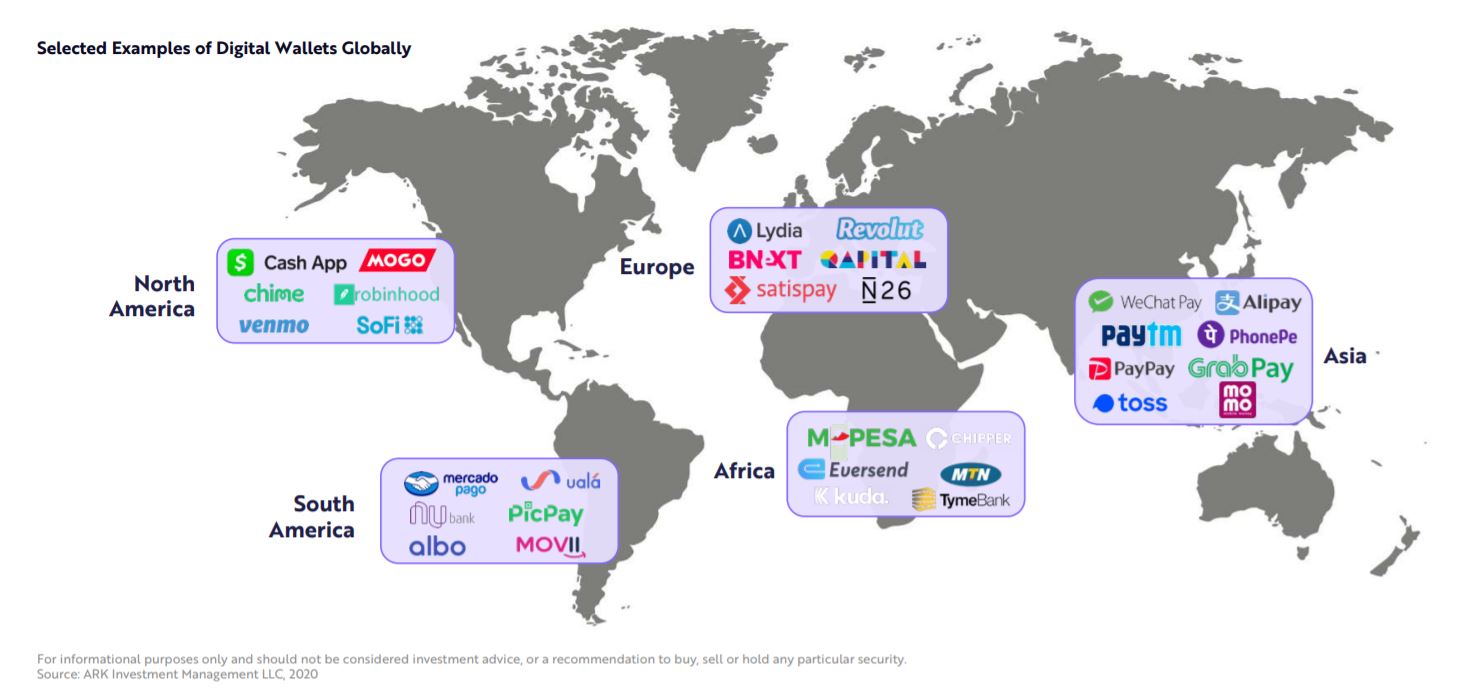

Digital Wallets - A Global Phenomenon

Meanwhile, in the US, Digital Wallets continually surpass the number of Account Holders at the largest Financial Institutions(Banks). In the last seven to ten years, Square's Cash and PayPal's Venmo each registered 60 million active users organically, a milestone that took J.P. Morgan more than 30 years to reach.

At the year ending 2020, J.P. Morgan Chase deposit account holders totaled 60 million approximately, whereas Cash App's and Venmo's Annual Active Users totaled 59 and 69 million, respectively.

Traditional Banks Are Facing Potentially Sizeable Risks

Digital wallet's arrival in the market suggests that traditional bank lending is unlikely to recover to its peak as in 2019. Following ARK's estimation, Bank interest income on credit cards fell more than 10%, i.e., $16 billion in 2020, and is likely to drop by more than 25%, from $130 billion in 2019 to $95 billion by 2025. And digital lenders such as Square, Paypal, Affirm, Klarna, and LendingClub are likely to take shares from traditional banks.

Read the complete research HERE