Look no further than the satellite broadband industry for proof that a new space race is begun. Half of the roughly 3,000 operational satellites circling Earth now are SpaceX's Starlink satellites. Because of the system's complexity, estimating the market opportunity for satellite broadband is difficult. ARK uses the following assumptions to model the opportunity:

The amount of users a satellite system can handle is limited by bandwidth. Because not everyone is online simultaneously, the system will be oversubscribed by a factor of 20. Individuals are ready to spend 2% of GDP per capita on high-speed internet access.

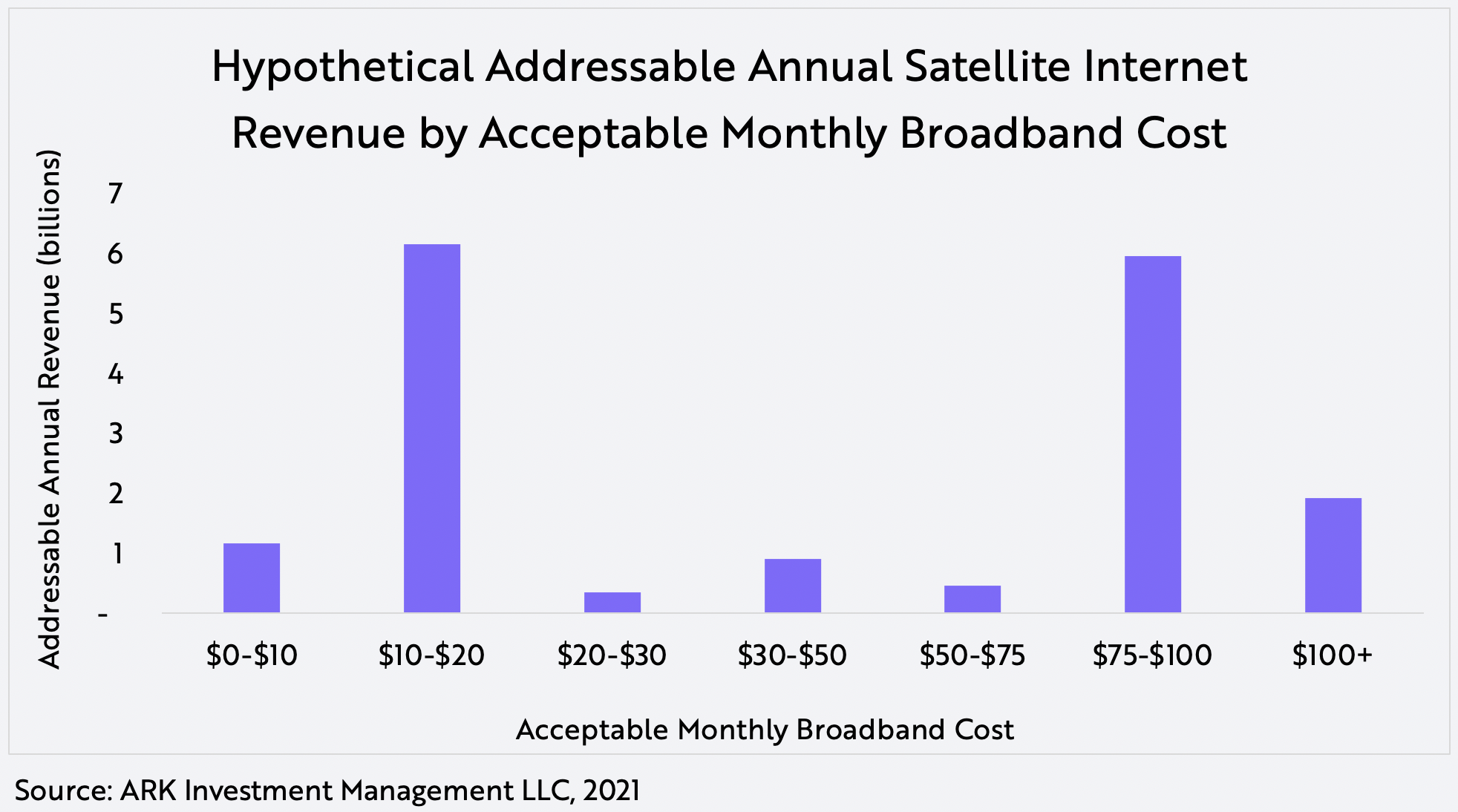

According to ARK's study, satellite broadband will split into two market sectors, generating about $17 billion in yearly income with a constellation of 12,000 satellites, as illustrated below. SpaceX plans to deploy 42,000 satellites in all, bringing the addressable market to more than $40 billion as bandwidth expands with more satellites. 1 We estimate that one client group will spend $75-$100 per month, while the other would pay $10-$20 per month. Early adopters will be at the top end of the market, allowing SpaceX to push prices down the satellite broadband learning curve and position itself to get into the cheap end.

Keep an eye out for an open-source version of this model that will allow you to tweak the model's significant assumptions and see how they affect the total addressable market for satellite broadband.

[1] The mobility end market and business clients are not included in this model.